Petrochemical price declines accelerate in China following tariffs

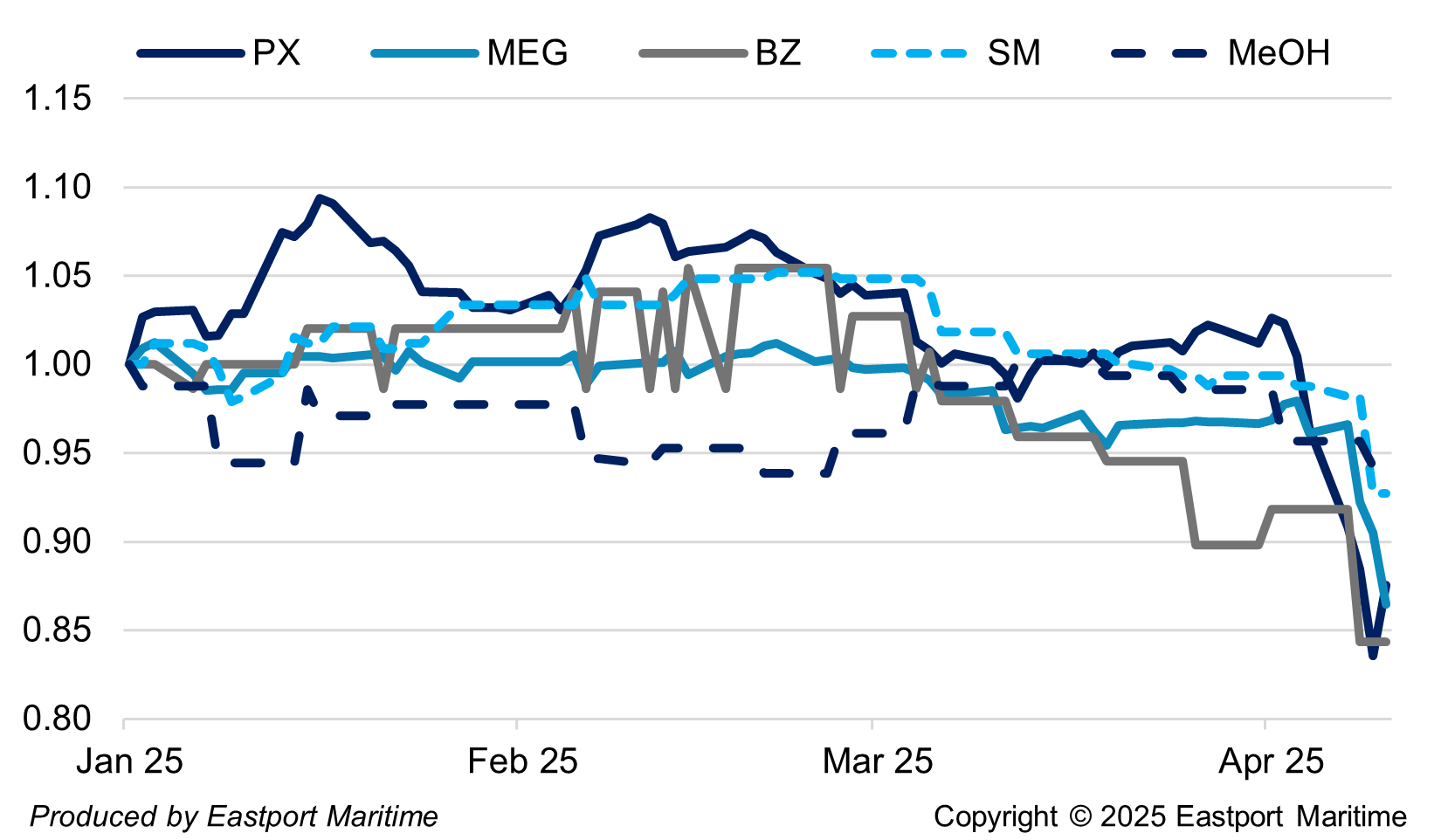

China bulk chemical price indices (1 Jan 2025 = 1, CNY prices)

Declines in petrochemical prices in China have accelerated following the imposition of tariffs by the US on Chinese imports. Petrochemical prices have declined between about 5-15% since the start of the year. Paraxylene (PX) imports fell by 16% YoY January-February due to weak downstream demand. Run rates at PX units also remained high in the first two months. East China benzene (BZ) inventories rose to 144kt on 8 April due to higher arrivals. China’s domestic styrene monomer (SM) supply may tighten due to plant maintenance in March-April while downstream producers plan to continue purchasing on a need-to basis. Chinese mono ethylene glycol (MEG) prices dropped in March on the back of ample supply and weak demand. MEG inventories at east China ports hovered around 600-700kt for the past month on slower-than-expected destocking. Downstream consumption was sluggish and polyester inventories are building up. Chinese MTO plant operating rates were expected to be stable, reported ICIS before the escalation of tariffs in April. Chinese methanol (MeOH) inventories at coastal areas are low. Rising overseas supply, coupled with low inventories, may support methanol imports near term. A Qatar Fuel Additives Company plant (1.1 mil mt/yr), Malaysia’s Sarawak plant (1.75mil mt/yr), and another 1.05mil mt/yr unit in Oman have reportedly restarted in the last two months. But if final demand slows, appetite for methanol and other petrochemicals may weaken.